You can also scroll through Xero’s default chart of accounts and customize it as needed, or import an already existing chart of accounts. If you have a list of customers and suppliers, you can import that, too. Includes tools that help automate the reconciliation process, along with a global search function; has a simple layout and a customizable dashboard.

Set up your small business in Xero

This Xero capability, found in many invoice software, will ultimately facilitate your bill pay and invoicing process. These ratings are meant to provide clarity in the decision-making process, but what’s best for your business will depend on its size, growth trajectory and which features you need most. We encourage you to research and compare multiple accounting software products before choosing one. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business.

Do I need accounting software for my small business?

Users can upgrade at any time to the Growing or Established plans for unlimited bills, purchase orders, and invoices. Have you ever wondered how a transaction would affect your books, but you didn’t want to risk messing up your financials? The demo company allows you to test out transactions and features completely separate from your business’ data. Utilizing the demo company, therefore, won’t affect anything you already have set up, nor will anyone else be able to see data you enter or import into the demo company.

Accounting software

Xero also has inventory management, but it’s not one of its core functions. After your free trial ends, you can choose the plan that best suits your needs. If you need payroll, you can add Gusto’s cloud-based payroll software to any of the plans.

Data Not Linked to You

Xero, a leading global platform for small businesses, has launched the 2024 Xero Beautiful Business Fund. The 2023 winners are an incredible group of small businesses and nonprofits who are passionate about solving problems and making an impact in their local communities. We’re spotlighting some of our past winners to hear more about how the fund has impacted their business and helped them achieve their goals.

For these reasons and more, Xero is our pick for the best accounting software for growing businesses. QuickBooks is available both online and via desktop and is ideal for businesses that outsource their accounting tasks to a bookkeeper or accountant. understanding variable cost vs. fixed cost This is because QuickBooks only allows up to 40 users for its highest-tiered plan, and even then, some plans require every user to pay for their own account. Xero is ideal for businesses that keep a team of bookkeepers or accountants in-house.

Run things smoothly, keep tidy online bookkeeping records, and make compliance a breeze. There is limited tax support, limited invoice templates, no built-in payroll, and a steep learning curve. Multiple pricing increases over the years have driven up the cost of the software, and customer support isn’t the best. While the software is well-organized, it does have a steep learning curve (not as steep as QuickBooks, but it is more difficult to learn than other cloud-based options). It takes quite a while to explore all of the features it has to offer, but once you get acquainted with the software, Xero is fairly easy to use. Getting started is the most difficult part, and it’s this learning curve that lowered our ease of use rating to 3.8/5.

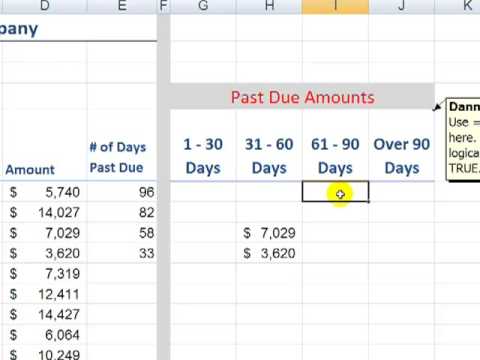

Instead of worrying about following up on your accounts receivable, let Xero take care of it for you. You can set up invoice reminders, configuring Xero to automatically send customers reminders based how to calculate safety stock safety stock formula and calculation on how far an invoice is past due. If you have regular invoices to send or bills to pay, save yourself the trouble of having to repeat the same process again and again with this Xero trick.

However, the upside is that Xero does not leave users hanging with long wait times. Instead, the company will call you back at a time convenient for you. Once you sign up, Xero provides several guided tutorials to acquaint you with its tools, such as connecting your business bank account, adding customers and creating invoices. Many pages within the app have how-to videos and links to a step-by-step guide, which is great for business owners who aren’t very tech-savvy. One cool feature is that Xero lets you schedule recurring invoices (or “repeating invoices”) by setting the send date, frequency and end date. Automatic payment reminders encourage customers to pay on time, saving you from following up and dealing with unpaid invoices.

An accountant or bookkeeper can be useful set of hands to help with the accounting heavy lifting. A global judging panel will then select one overall winner from each category, awarding an additional R550,000 each. Mygrow, a neuroscience-based software that enhances employee emotional intelligence, won the “Trailblazing with technology” category. Curate, a platform connecting content creators with clients, won the “Upskilling for the future” category.

Xero processes payment through a payment gateway like Stripe, GoCardless and others. Keep in mind that these services charge a fee to process payments (usually around 2.9% plus 25 cents per transaction, though this varies by the payment processor). With Xero, all plans include a bank reconciliation tool that suggests transaction matches for you, making it easy to reconcile bank accounts. If a bank statement line meets the set of criteria you specified, Xero will suggest creating a matching transaction for you. Additionally, Xero’s customizable dashboard and global search function make the software easy to navigate.

- Set up bank feeds from your accounts so transactions are imported securely into the Xero accounting software each business day.

- While the software is well-organized, it does have a steep learning curve (not as steep as QuickBooks, but it is more difficult to learn than other cloud-based options).

- QuickBooks is also better for businesses that need to track inventory, as it has built-in inventory management features.

- Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more.

- If your business is large enough that you can’t (or don’t want to) send invoices, read reports, and reconcile bank transactions on your own, Xero is an efficient, affordable choice.

In general, we were pleased with Xero’s customer support options. However, they were not as comprehensive as what we found in our review of QuickBooks Online. Phone support is not available immediately; you must contact customer service first via email or live chat.

Unlike many competitors, Xero’s pricing and plans are based on features instead of user numbers. In fact, all of Xero’s plans support unlimited users, which is great for what is a chart of accounts a small business bookkeeping guide expanding businesses. Xero also integrates with over 1,000 third-party business apps – among the most integrations of any accounting software package we reviewed.

Project tracking tools in higher-tier plans; lacks industry-specific reports and transaction tracking tags; users with multiple businesses must pay for separate subscriptions. Includes project tracking tools in most expensive plan; limited transaction tracking tags; lacks industry-specific reports; users with multiple businesses must pay for separate subscriptions. The desktop version is installed on a computer, while the online version is accessed through a web browser. QuickBooks Online includes all the components of the desktop version, plus additional features such as more app integrations, a fully functional mobile app and more attractive pricing. The Online plans start at $30 per month, whereas the Desktop plans must be paid annually and start at $492 per year. QuickBooks is a popular accounting software used by small businesses, solopreneurs and freelancers.

Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business. From reconciling bank transactions to sending invoice reminders, it works for you. Access Xero features for 30 days, then decide which plan best suits your business. Make Xero your own by connecting other apps to the Xero accounting software. Easy to use accounting software, designed for your small business.